Documents

Update to our report originally published 08-Oct-2014 (below) --

- We reiterate our negative opinion on Cisco's disclosure practices. We see nothing to move us from that view.

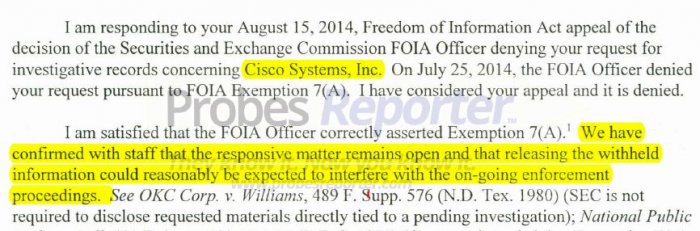

- In a letter dated 7-Jan-2015 we received information from the SEC reaffirming Cisco's involvement in unspecified SEC investigative activity.

- The Cisco 10-Q filed 20-Nov-2014 repeats in form and substance (almost verbatim) earlier disclosures that we continue to find misleading regarding an ongoing Foreign Corrupt Practices Act exposure.

Below is the full text of our report first published 08-Oct-2014 --

Opinion Summary: In our opinion Cisco Systems, Inc. (CSCO) has been engaging in disclosure practices regarding SEC investigative activity that we found to be curious, if not troubling. Repeatedly we found Cisco made choices regarding timing, venue, and language that appear designed to mislead investors and/or keep material information from them regarding SEC exposures.

Using Freedom of Information Act (FOIA) requests going back to 2012, we were able to learn of a substantial volume of SEC investigative activity never disclosed by Cisco.

As recently as the 10-K filed in September, we observed that Cisco still had not directly stated it is under investigation by the SEC & DOJ for potential violations of the Foreign Corrupt Practices Act (FCPA), but we know it is; and has been since at least 2013.

The language repeatedly used by Cisco to describe its FCPA exposure is so clever as to make it easily misleading.

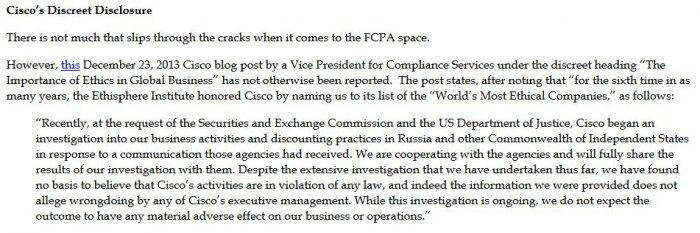

Perhaps most disturbing is the advanced stealth tactics Cisco appeared to deploy when first disclosing what has now become its protracted FCPA investigation.

Mainstream media first widely reported Cisco's FCPA problems after disclosure was made in a 10-Q filed on 20-Feb-2014. But the first disclosure was actually made back on 23-Dec-2013, after most people had already left for the Christmas holiday, buried within a discreet blog posting a senior attorney for Cisco had posted on the importance of ethics.

Cisco did file an 8-K this same day, 23-Dec-2103, but the investigation disclosed in the blog posting was not mentioned or even vaguely referenced. Ostensibly, the purpose of the blog posting was for Cisco to talk-up and even congratulate itself for its commitment to ethics. Now it just seems ironic.

The balance of this report presents records we acquired under the Freedom of Information Act on Cisco since 2012. We compare these records to company filings and offer our analysis of the same.

Like all of our reports, this report on Cisco Systems, Inc. illustrates ways our members will be able to use our database of FOIA records to prepare analyses like this on their own starting next year. Become a member today and you will get free email alerts on future reports and access to our archive. Registration is currently free.

-----------------------------------------

"Ethics and integrity are part of our DNA and ingrained in our culture and the way we conduct every aspect of our business.”

- Roxane Marenberg, Deputy Counsel for Cisco (7:11 pm EST, 23-Dec-2013), asserting Cisco's commitment to ethics within the very same off-the-radar blog posting her company first used to disclose a Foreign Corrupt Practices Act probe.

Facts of Interest or Concern:

- Going back to 2010 we found no direct disclosures of SEC investigative activity in Cisco's filings.

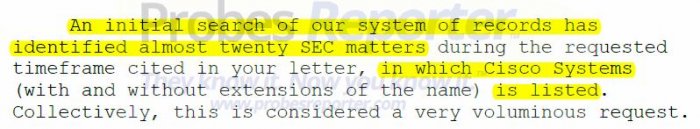

- SEC letters to us sent this year referenced, “almost twenty SEC matters” in which Cisco Systems is listed.

- We know of four SEC investigations in which Cisco was named since 2010. They lasted from 3-23 months each. Again, none were disclosed. According to the SEC, they are –

- In the matter of Cisco Systems, Inc., which opened on November 4, 2010, and closed on March 30, 2012;

- In the matter of Cisco Systems, Inc., which opened on April 2, 2010, and closed on March 30, 2012;

- In the matter of Cisco Systems, Inc., which opened on August 16, 2011 and closed on May 17, 2013; and

- In the matter of Cisco Systems, Inc., which opened on February 5, 2013, and closed on May 31, 2013.

On the above, the SEC added, “This information should not be interpreted to indicate that the subject of your request [Cisco] was the subject of a Commission matter. In addition, please note that we are unable to confirm from our computerized database index of records whether the company listed is the same company of interest to you.”

Despite SEC vacillation just above, we nonetheless have documents naming Cisco specifically and solely in multiple investigations in the years 2010-2013. They are posted here.

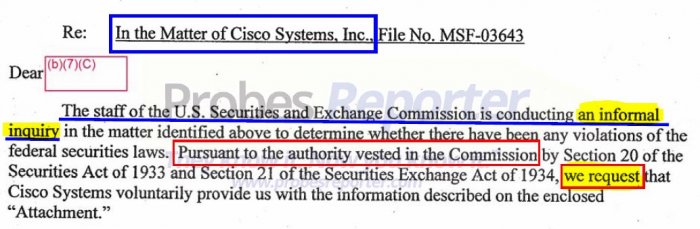

- A response we received from the SEC dated 29-Sep-2014 confirms on-going enforcement proceedings involving Cisco. The full letter is posted. Here is an excerpt --

- We know Cisco is under investigation by the SEC and DOJ for potential violations of the Foreign Corrupt Practices Act, and has been since at least 2013. But the company has yet to directly state this.

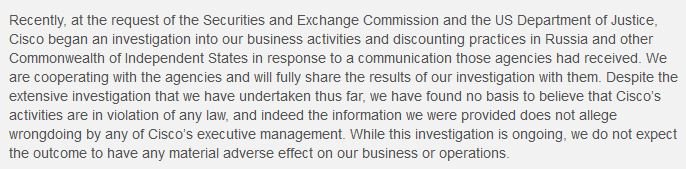

- Cisco first disclosed its FCPA problems in an obscure blog posting made at 4:11 pm PST (7:11 EST) on 23-Dec-2013 (for business purposes, this was effectively a Christmas Eve disclosure of a material event). At this time a Vice President for Compliance Systems at Cisco made a blog posting discreetly titled, “The Importance of Ethics in Global Business”.

Tucked within that same blog posting, supposedly crafted to tout what an ethical a company it is, Cisco also made its first disclosure into what we know to be a joint SEC/ DOJ investigation into potential violations of the Foreign Corrupt Practices Act.

The author’s bio posted with the article does not identify her as an attorney for the company nor does it show her having made other blog postings. However, one source identified her as an attorney in charge of global employment law for Cisco. Another identified her as Deputy Counsel for the company.

Mainstream media did not pick upon the blog posting announcing the internal investigation. But that same media gave wide coverage to the FCPA matter when it finally made it to an official SEC filing; the 10-Q filed 20-Feb-2014.

Even the "FCPA Professor, A Forum Devoted to the Foreign Corrupt Practices Act" which makes its living scanning for FCPA matters, did not pick up on the Cisco disclosure until 14-Feb-2014, as indicated below --

- As recently as the 10-K filed on 9-Sep-2014, and in all disclosures on the matter until then, Cisco claims it started an internal investigation regarding its FCPA exposure "at the request" of the government. Though the company claims it is, "... fully cooperating with and sharing the results of our investigation with the SEC and the Department of Justice.", the company never directly states it is under investigation by those very same entities and has been since at least 2013. This is from the 10-K filed on 9-Sep-2014:

- Russia and the Commonwealth of Independent States At the request of the U.S. Securities and Exchange Commission (SEC) and the U.S. Department of Justice, we are conducting an investigation into allegations which we and those agencies received regarding possible violations of the U.S. Foreign Corrupt Practices Act involving business activities of Cisco's operations in Russia and certain of the Commonwealth of Independent States, and by certain resellers of our products in those countries. We take any such allegations very seriously and are fully cooperating with and sharing the results of our investigation with the SEC and the Department of Justice. While the outcome of our investigation is currently not determinable, we do not expect that it will have a material adverse effect on our consolidated financial position, results of operations, or cash flows. The countries that are the subject of the investigation collectively comprise less than 2% of our revenues. [emphasis added]

- Russia and the Commonwealth of Independent States At the request of the U.S. Securities and Exchange Commission (SEC) and the U.S. Department of Justice, we are conducting an investigation into allegations which we and those agencies received regarding possible violations of the U.S. Foreign Corrupt Practices Act involving business activities of Cisco's operations in Russia and certain of the Commonwealth of Independent States, and by certain resellers of our products in those countries. We take any such allegations very seriously and are fully cooperating with and sharing the results of our investigation with the SEC and the Department of Justice. While the outcome of our investigation is currently not determinable, we do not expect that it will have a material adverse effect on our consolidated financial position, results of operations, or cash flows. The countries that are the subject of the investigation collectively comprise less than 2% of our revenues. [emphasis added]

- Those interested in learning more about this probe may find the following interesting -

Analysis – Our Take:

-

That Cisco chose an obscure company blog posting, at the time it did, to first disclose its FCPA exposure feels like a serious violation of investor trust. Timing of the blog posting cited above, at 7:11 pm EST on 23-Dec-2013, effectively made it a Christmas Eve disclosure sure to be seen by few. The news coverage - or lack thereof - suggests it worked. Investors deserve better from a company that enjoys a position among the widely followed Dow Jones Industrial Average.

-

For Cisco to refer to its internal FCPA investigation while not directly stating that the SEC & DOJ are actually investigating company is what we call a "stealth disclosure" of an SEC probe. Stealth disclosures fall into the realm of sleazy disclosure tactics we sometimes see deployed by public companies. Ego of senior executives can be a factor. However, the motive more typically is that a public company wants to meet its obligation to disclose a material event without suffering the potential market consequences that can accompany disclosure of SEC investigations.

-

We find Cisco’s characterization of having started an internal investigation "at the request" of the government to be so misleading as to bring into question the veracity of everything else the company has disclosed about its FCPA probe.

While we must allow there could be potential benefits to both regulators and Cisco in having the company conduct its own investigation, and we'd expect Cisco would want to anyway, we also believe the "request" Cisco keeps referring to could easily be the notice it first received from the SEC of an informal inquiry. That Cisco has never directly stated the SEC & DOJ are investigating makes us more inclined to believe that conclusion.

Below is an illustration of a previous “request” Cisco received from the SEC in an earlier, undisclosed informal inquiry. We think this is more likely the type of "request" Cisco received regarding its FCPA probe that, in turn, prompted the company to start its own internal investigation –

- Cisco's updates on its FCPA exposure are of little analytical value, if only because they essentially repeat what's been previously disclosed without offering any meaningful new information. Government investigations typically involve documents, correspondence, testimony, and ongoing negotiation between the parties. Rather than simply parroting what has been previously disclosed, investors should insist Cisco provide more substantive updates. There is no SEC restriction to keep Cisco from doing this. They simply choose not to.

- Though we believe Cisco's FCPA probe started out informal, investors should ask whether the investigation has since become formal. Make no mistake; even an informal SEC investigation can have severe consequences for a company. Not all formal investigations should be viewed as escalations though.

One of the biggest distinctions between an informal and a formal investigation is subpoena power. Sometimes subpoenas are simply needed in ways that would not be a negative reflection on the primary party under investigation (e.g., a vendor might not want to upset a large customer by providing information to the SEC without "being forced to").

However, in the case of Cisco, if the FCPA probe has indeed become formal we think that could easily signal a potential escalation, likely due to a lack of cooperation on the part of Cisco. The easiest way to find out if any SEC probe is formal is to simply ask a company if it received a subpoena from the SEC. Subpoenas are not used in informal inquiries.

- The consequences of undisclosed SEC investigations can be severe. We also know some SEC investigations go nowhere, so we are not necessarily critical of Cisco for not disclosing all the probes we discovered. However, in our experience the volume of undisclosed SEC activity we found involving Cisco is unusually high and should not be ignored by investors.

- The self-defined standards of materiality at a company with a lot of undisclosed SEC activity may be higher than might be used by other public companies without as much activity. That is, something would have to be “really bad” before such a company would disclose a probe. By implication, the sole investigation Cisco did disclose, the FCPA probe; should be assumed as material and posing a far bigger risk than company disclosures otherwise suggest.

- FCPA probes get into matters of accounting and internal controls. They can have negative operating consequences for a company long after the investigative activity is over. To illustrate, what happens to a company's capacity to operate in markets where bribes were previously used as a tool of business? This is one of many perspectives on FCPA probes we don't think investors allow for.

To learn more on our process and what our findings mean, click here.

Notes: The SEC disclosed only few details and documents on investigations referenced above. On some they disclosed no additional information nor did they release additional records. The SEC reminds us that its assertion of the law enforcement exemption should not be construed as an indication by the Commission or its staff that any violations of law have occurred with respect to any person, entity, or security. New SEC investigative activity could theoretically begin or end after the date covered by this latest information which would not be reflected here.